Recession watch? Not yet.

In 2007, economist Ed Leamer published an article titled “Housing IS the Business Cycle.” Compared to the generally impenetrable writing common in academia, his lead sentence was about as straightforward as could be: “Of the components of GDP, residential investment offers by far the best early warning sign of an oncoming recession.”

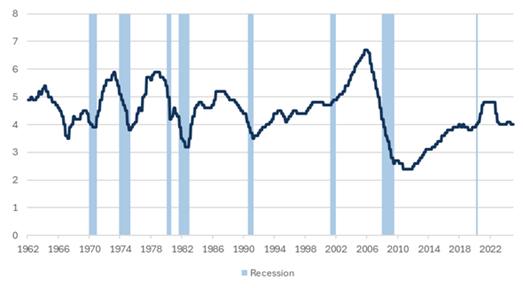

Residential investment isn’t flashing a warning sign at the current time (Fig. 1), but it is released quarterly with a one-month lag, which makes using it to identify sharp turning points challenging.

Fig. 1: Residential Investment, percentage of GDP

Source: Bloomberg, Mill Creek.

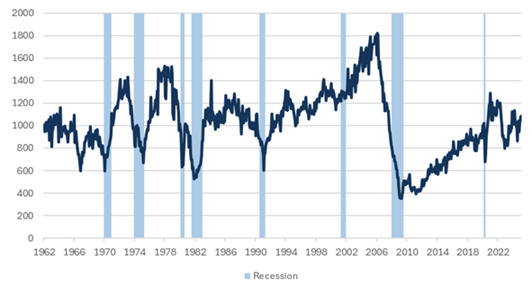

However, housing starts, which are reported on a monthly basis, tend to follow coincidently with residential investment. Whenever housing starts fall 30% or more from its recent peak, we generally experience a recession (Fig. 2). Housing starts are currently down about 4% from its high over the last 24 months, which is nowhere near a decline commensurate with a forthcoming recession.

Fig 2: New Home Starts (thousands)

Source: Bloomberg, Mill Creek.

There are caveats to any forecasting model, and Fig.2 illustrates two false positives and one false negative. The false positives were 1966 (the Vietnam wartime economy kept the economy out of recession) and 2022 (a decline in starts that was a slowdown from the COVID boom). The false negative was the mild recession that followed the dot-com bust.

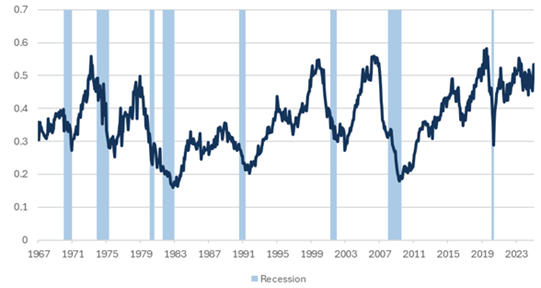

We’re not myopically focused on residential investment as a guide to this cycle. Heavy truck sales are also a good leading indicator (Fig. 3), and aggregate income growth, which continues to grow at 4-5% annually, might be the most important baseline indicator of consumer health. Neither gives us pause about the state of the economy at this juncture.

Fig. 3: US Heavy Truck Sales (millions, seasonally adjusted annual rate)

Source: Bloomberg, Mill Creek.

To sum it up – what is economic data telling us right now? That it’s premature to be concerned about a US recession.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.